Roth 401 K Contribution Limit 2025 Lok. The maximum amount you can contribute to a roth 401 (k) for 2025 is $23,000 if you're younger than age 50. 2025 401(k) faqs how much can i contribute to my 2025 roth 401(k)?

As of 2025, individual employees have a 401 (k) contribution limit of $19,500, allowing them to contribute this amount annually to their 401 (k) account on a. The amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,000, up from $22,500 for 2025, the irs announced.

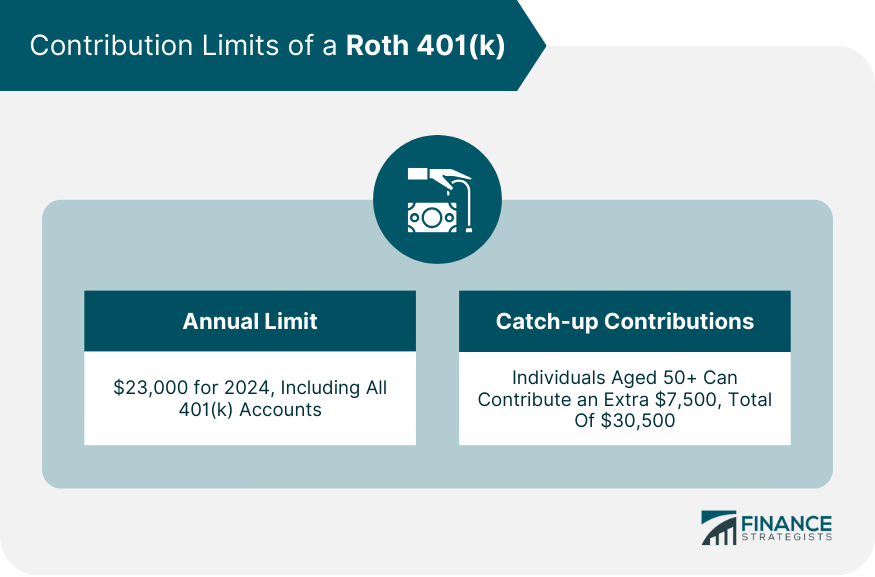

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, Roth 401 (k)s are funded. Roth 401 (k) contribution limits are the same as the traditional 401 (k) limits of $23,000 in 2025, or $30,500 for those 50 and older.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, 401k contribution limits 2025 with employer match kaile. The roth 401(k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

Last Day To Contribute To 2025 Roth Ira Fred Joscelin, As an individual, you can only contribute up to $22,500 to traditional and roth 401(k)s and $15,500 to simple 401(k)s in 2025 — or $23,000 and $16,000 in. 401k contribution limits 2025 with employer match kaile.

2025 Roth Ira Contribution Limits Allix Violet, The maximum amount you can contribute to a roth 401 (k) for 2025 is $23,000 if you're younger than age 50. In 2025, the irs has increased the standard employee contribution limit for 401 (k) plans to $23,000.

What’s the Maximum 401k Contribution Limit in 2025? (2025), In 2025, the irs has increased the standard employee contribution limit for 401 (k) plans to $23,000. The 401 (k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older.

What Is a Roth 401(k)? Here's What You Need to Know theSkimm, (however, you could be subject to lower contribution limits if you're deemed a highly. 2025 401 (k) contribution limits.

What Is The Roth 401 K Limit For 2025, 2025 401(k) faqs how much can i contribute to my 2025 roth 401(k)? This is an extra $500 over 2025.

401k 2025 Contribution Limit Over 50 Dodi Nadeen, The contribution limit for roth 401(k) accounts is the same as a traditional 401(k) account: For 2025, the limit is $23,000, or $30,500 if you're 50 or older.

Roth 401(k) Definition, How It Works, Eligibility, Pros and Cons, Roth 401 (k) contribution limits are the same as the traditional 401 (k) limits of $23,000 in 2025, or $30,500 for those 50 and older. The 401 (k) contribution limits in 2025 have increased for employees to $23,000.

Contribution Limits for 2025 401(k), Roth IRA, HSA YouTube, The 401 (k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older. In 2025, the irs has increased the standard employee contribution limit for 401 (k) plans to $23,000.

The maximum amount you can contribute to a roth 401 (k) for 2025 is $23,000 if you're younger than age 50.